UK Credit Card Trends 2023-24: FICO Data Shows Rising Spend and Missed Payments

Year-on-year analysis reveals impact of continued high costs and inflation requiring lenders to remain vigilant

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240701357732/en/

FICO data on

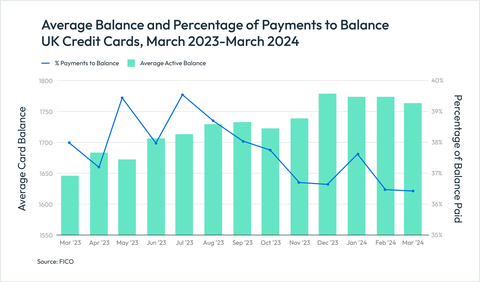

Overall, consumer spend was up and payments to balance down year-on-year with credit card balances remaining high, having returned to pre-pandemic levels. The 12-month period also saw greater use of credit cards to withdraw cash.

Highlights

- Month-on-month fluctuations in credit card spend followed seasonal trends in 2023, however spending was higher than previous years in every month

-

December 2023 saw average spend perUK credit card reach £850 - the highest since FICO records began in 2006 -

The percentage of payments being made compared to the overall balance has been trending down since

July 2023 (apart from the expected seasonal increase in January), and currently stands at 36.4% -

Balances are now back to levels seen pre-COVID, after dropping during the pandemic;

December 2023 saw a record high of £1,780 - In nearly every month, the proportion of customers missing payments increased year-on-year and established credit card holders (1-5 years) are the most likely to miss payments

- The number of customers using credit cards to withdraw cash rose year-on-year but remains lower than pre-pandemic levels

FICO Guidance

With customers paying down less of their balances, more customers will fall into the persistent debt category (over a period of 18 months, a customer pays more in interest, fees and charges than they have repaid of the principal). In a Consumer Duty world, FICO recommends that firms are actively identifying these customers at an early stage and reviewing their communications, to encourage higher payments in support of achieving better value from their credit card. This review should be comprehensive and include payment and communications channels which best engage and empower the customer to manage their finances proactively reaching out to customers before they move into each of the persistent debt stages will help to ensure they are on the right product based on their current affordability needs.

With more customers missing payments compared to this time last year, FICO also recommends implementing pre-delinquent strategies and reviewing those already in production to try and reduce the number and amount of balances moving forwards into delinquency. These strategies will support firms in both their attempts to avoid foreseeable customer harm and also carrying potentially avoidable loss provisions, under IFRS 9.

Data and Analysis

Spending has remained high as payments to balance has trended down

Continued high inflation and higher prices for goods has kept spending high throughout the past 12 months. Seasonal fluctuations have continued as expected, and the level of spending has remained steadfastly higher than 2022-23.

The percentage of payments being made compared to overall balances has been trending down since

FICO advises:

As spending and balances increase and remain high, risk teams should review the number and amount of credit card limits being offered to ensure they increase in line with these higher balances. Customers going over their credit card limit should also be reviewed for potential limit increase offers.

Missed payments for New, Established and Veteran card holders

The number of customers missing one, two or three payments has been erratic month-on-month throughout 2023-24. And when comparing year-on-year, the proportion of customers missing payments increased almost every month.

The last 12 months has also seen a change in the behaviour of different segments of cardholders most likely to miss payments.

Before the pandemic, the number of customers missing either one, two or three payments was always higher for the New segment, those who have held the card for less than 12 months. This was expected, as this group of customers had recently taken out cards so were more credit hungry and likely to miss payments. This group also contains first-party fraudsters with no intention of repaying balances.

However, post-pandemic, it is the Established group of customers (those who have held the card for between one and five years) who are now more likely to miss payments. Reasons for this include:

- They would have taken out cards during the pandemic, when their affordability may have looked better than usual due to lack of spending opportunities and increased savings.

- Over the last 12 months, many of these customers would have come to the end of promotional balance transfer offers at a time when interest rates are higher than they were previously.

- The range of balance transfer offers has also declined, meaning they may now be having to pay back these balances at a higher rate than expected.

For the Veteran segment, customers who have held their card for more than five years, the increase in missed payments is even more apparent. One, two and three missed payment balances have all increased at a higher rate since

FICO advises: To meet Consumer Duty requirements to proactively reach out before customers become overindebted and affordability issues worsen, risk teams should focus on supporting Established customers who are not managing to pay down their balances. More specialised collections treatment may be appropriate, perhaps moving customers onto a different card that more suits their changing risk profile or reviewing their credit card limit. Supporting customers through challenging times now will boost loyalty and keep them as a long-term customer.

Risk teams should focus on supporting Established customers who are not managing to pay down non-promotional balances, and take proactive action before promotional APRs expire — perhaps move them onto a lower rate, which is also a good incentive to try and keep customers loyal to their bank.

Cash withdrawals on credit cards

In

Since

FICO advises:

Analytical teams should review risk models on an annual basis to ensure they still rank-order risk effectively, especially when models segment customers by cash usage. Risk teams should also consider risk-based cash limit strategies, as well as monitoring the number of cash transactions being accepted, even for underlimit customers.

These card performance figures are part of the data shared with subscribers of the FICO® Benchmark Reporting Service. The data sample comes from client reports generated by the FICO® TRIAD® Customer Manager solution in use by some 80% of

About FICO

FICO (NYSE: FICO) powers decisions that help people and businesses around the world prosper. Founded in 1956, the company is a pioneer in the use of predictive analytics and data science to improve operational decisions. FICO holds more than 200 US and foreign patents on technologies that increase profitability, customer satisfaction and growth for businesses in financial services, insurance, telecommunications, health care, retail and many other industries. Using FICO solutions, businesses in more than 100 countries do everything from protecting 4 billion payment cards from fraud, to improving financial inclusion, to increasing supply chain resiliency. The FICO® Score, used by 90% of top US lenders, is the standard measure of consumer credit risk in the US and other countries, improving risk management, credit access and transparency. Learn more at www.fico.com.

FICO and TRIAD are registered trademarks of

View source version on businesswire.com: https://www.businesswire.com/news/home/20240701357732/en/

For further comment on the FICO

FICO

ficoteam@harrisonsadler.com

0208 977 9132

Source: FICO