FICO UK Credit Card Market Report: February 2023

Data demonstrates cost-of-living pressures across spend and missed payments as

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230427005063/en/

The FICO

There are, however, some positive signs of financial management. The percentage of accounts missing one payment dropping significantly month-on-month in February after two months of high increases. The number of accounts missing two payments has also seen the first significant drop since

Highlights

-

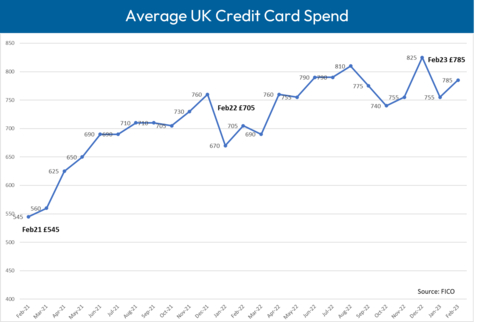

Average total sales up 3.7 percent compared to

January 2023 at £785 - Percentage of payments to balance dropped by 4.1 percent month-on-month

-

Percentage of accounts missing one payment decreased by 15.6 percent compared to

January 2023 -

Percentage of accounts with two missed payments decreased 12.6 percent compared to

January 2023 , although 25 percent higher thanFebruary 2022 - Accounts missing three payments continued to rise, up 27.4 percent year-on-year

- Average balances across all accounts up 8.7 percent year-on-year to £1,660

FICO comment

Analysis of the largest consortium of

As living standards continue to be squeezed, it’s not surprising that the percentage of payments to balance has dropped consistently since

How consumers manage their existing financial commitments is also crucial to monitor in the current climate. The fact that the percentage of customers missing one payment decreased significantly in

The percentage of customers missing three payments has significantly increased since

Key Trend Indicators –

|

Metric |

Amount |

Month-on-Month Change |

Year-on-Year Change |

|

Average |

£785 |

+3.7% |

+11.4% |

|

Average Card Balance |

£1,660 |

+0.6% |

+8.7% |

|

Percentage of

|

37.8% |

-4.1% |

-2.3% |

|

Accounts with

|

1.4% |

-15.6% |

+0.7% |

|

Accounts with

|

0.3% |

-12.6% |

+25.1% |

|

Accounts with

|

0.2% |

+4.3% |

+27.4% |

|

Average Credit Limit |

£5,550 |

-0.4% |

+1.4% |

|

Average Overlimit Spend |

£90 |

+1.1% |

-24.6% |

|

Cash Sales / Total Sales |

0.9% |

+0.7% |

-32.8% |

Source: FICO

These card performance figures are part of the data shared with subscribers of the FICO® Benchmark Reporting Service. The data sample comes from client reports generated by the FICO® TRIAD® Customer Manager solution in use by some 80 percent of

About FICO

FICO (NYSE: FICO) powers decisions that help people and businesses around the world prosper. Founded in 1956, the company is a pioneer in the use of predictive analytics and data science to improve operational decisions. FICO holds more than 200 US and foreign patents on technologies that increase profitability, customer satisfaction and growth for businesses in financial services, telecommunications, health care, retail and many other industries. Using FICO solutions, businesses in nearly 120 countries do everything from protecting 2.6 billion payment cards from fraud, to helping people get credit, to ensuring that millions rental cars are in the right place at the right time.

Learn more at https://www.fico.com

FICO and TRIAD are registered trademarks of

View source version on businesswire.com: https://www.businesswire.com/news/home/20230427005063/en/

FICO

ficoteam@harrisonsadler.com

0208 977 9132

Source: FICO